How to use Killzones in Trading

How to use Killzones in Trading - Why is it important to trade during killzones ? You've probably already heard of the concept of time and price. Well, killzones are periods of time when there is the most volatility in the market and where there are the most interesting opportunities to make good trades.

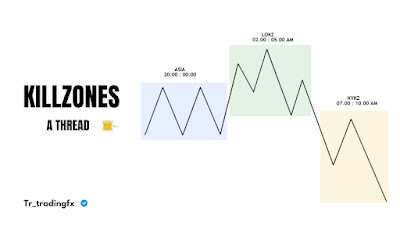

What are the schedules of the different Killzones ?

- Asia -> 20.00 : 00.00 - Midnight open -> 00.00

- London Killzone -> 02.00 : 05.00 am

- New York Killzone -> 07.00 : 10.00 am All the hours here are expressed in UTC-4, New York time

Personally, I never trade outside of these three Killzones because prices tend to be much less reactive, and I advise you to do the same. You'll likely see your win rate increase just by understanding how this concept works.

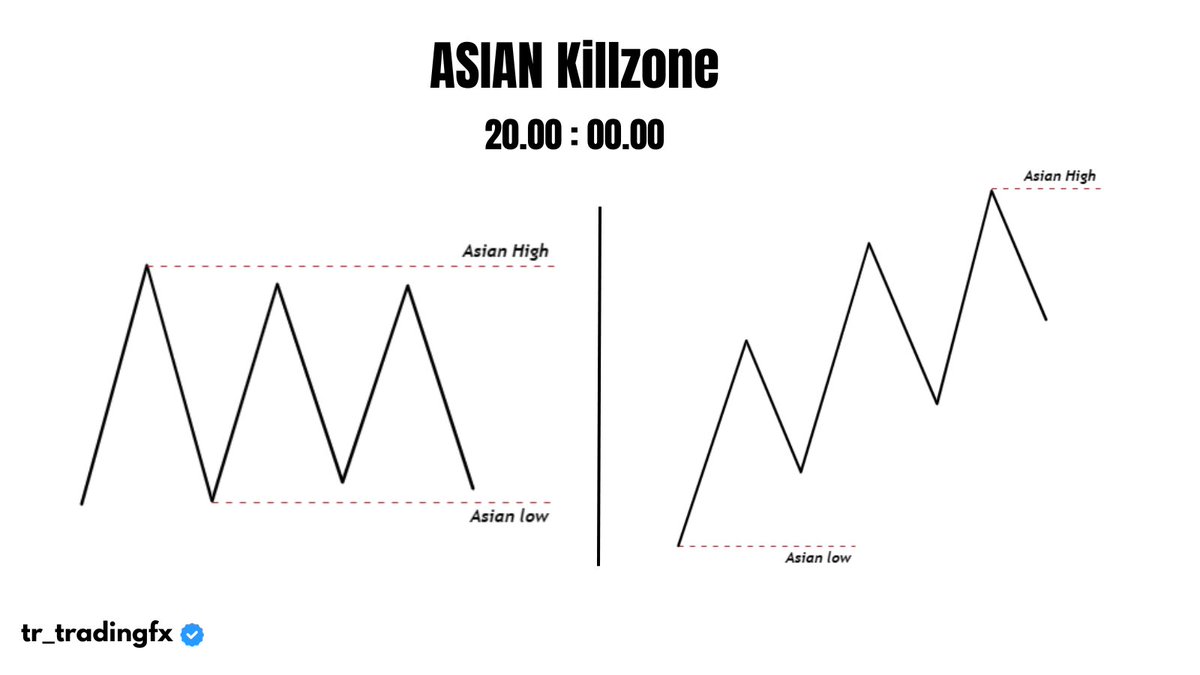

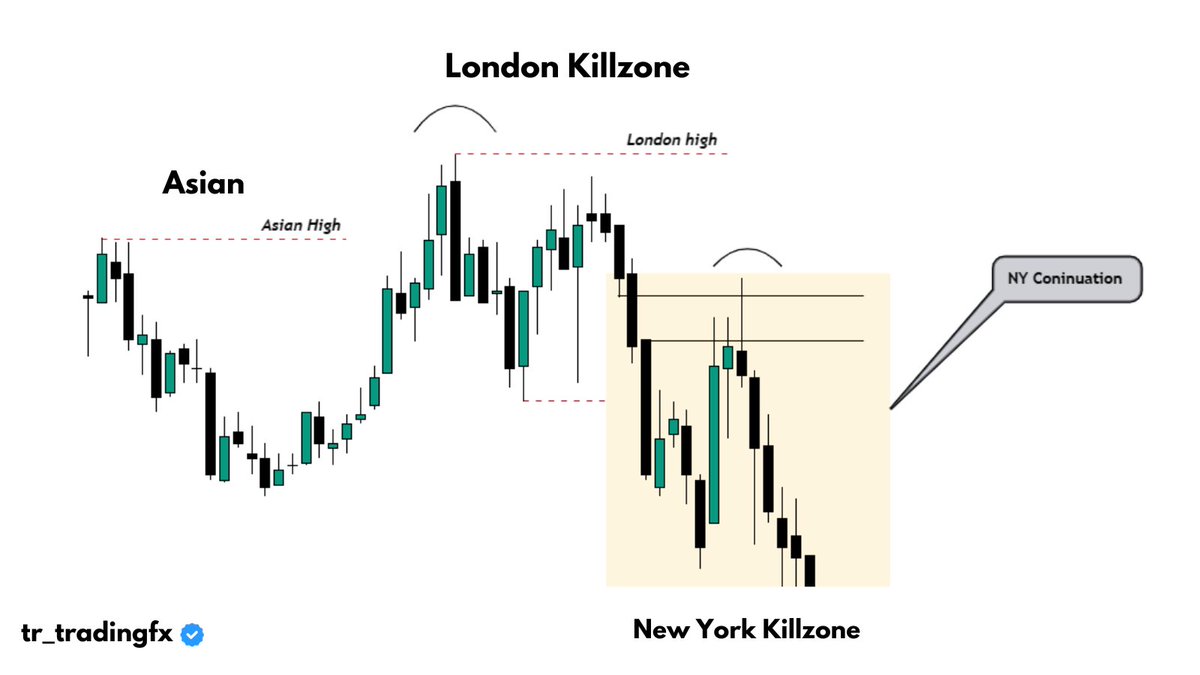

Asian Killzone Most of the time, the Asian KZ will range until the Midnight open, creating suspended liquidity for the price to reach during the London session. Sometimes, the Asian session expands, but it remains less interesting in terms of opportunities.

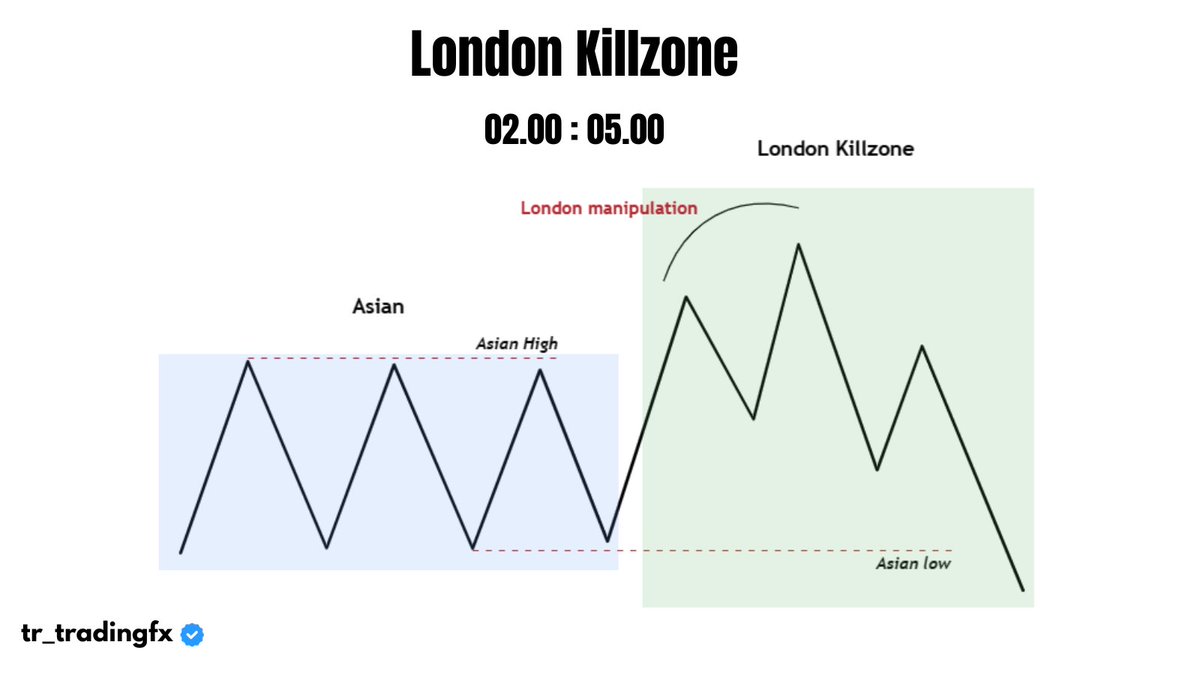

London Killzone The London killzone typically taps into the liquidity from the Asian session to become independent from it but also to prepare for a move and seek out other liquidity. London manipulates the price to access liquidity and then makes its true move afterward

Always be patient and wait for a real price manipulation before taking a position, and that's where the principle of time & price makes all its sense. With time, you'll easily recognize the manipulation period and make better decisions.

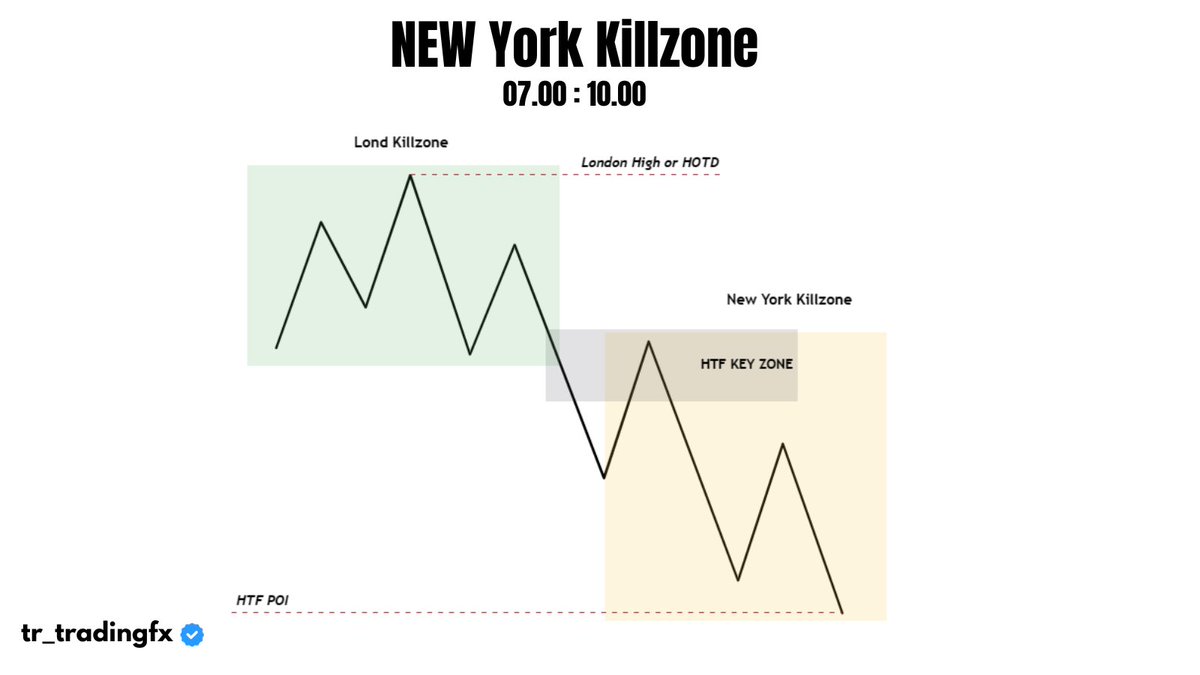

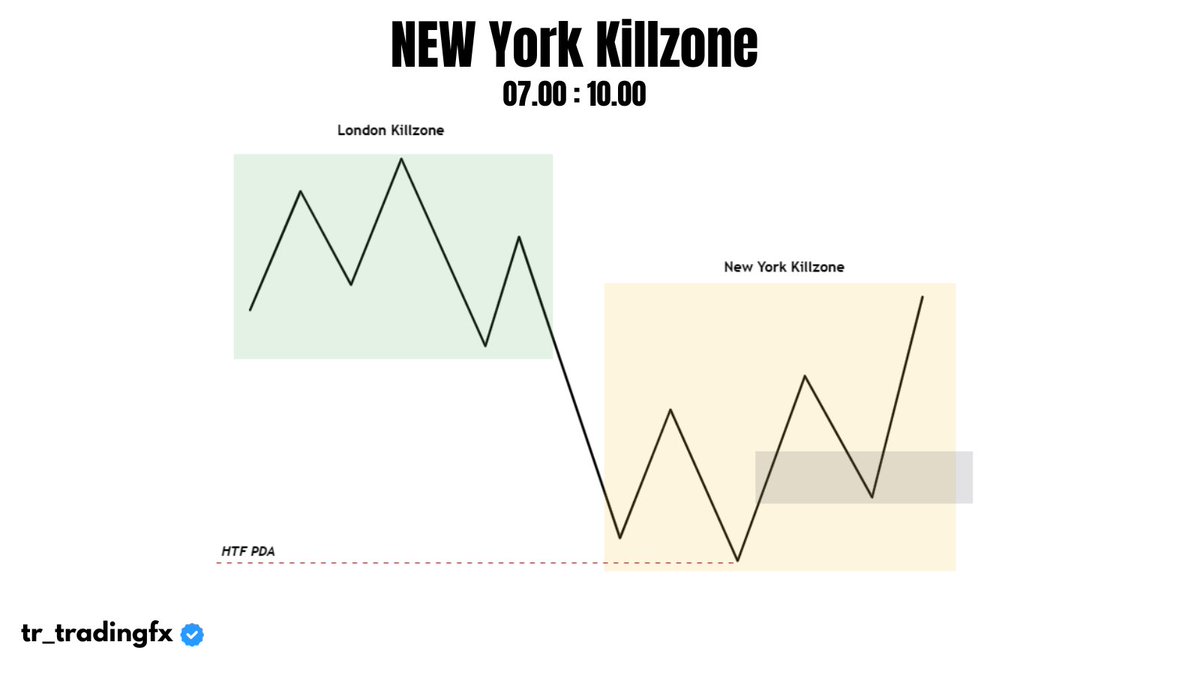

New York Killzone In the best-case scenario, the New York Killzone acts as a continuation based on the London session, which we call a Classic buy/sell day. Asian range -> London reversal -> NY continuation

But it can also happen that NY acts in reversal, it all depends on where the liquidity is and what the price objective is. You should always ask yourself where the price is going to go to fetch such and such liquidity.

What I'm showing you here are the best-case scenarios, but sometimes the market decides differently, it's up to you to gain experience as you use them. When I discovered the killzones, it was a real change in my market perspective.

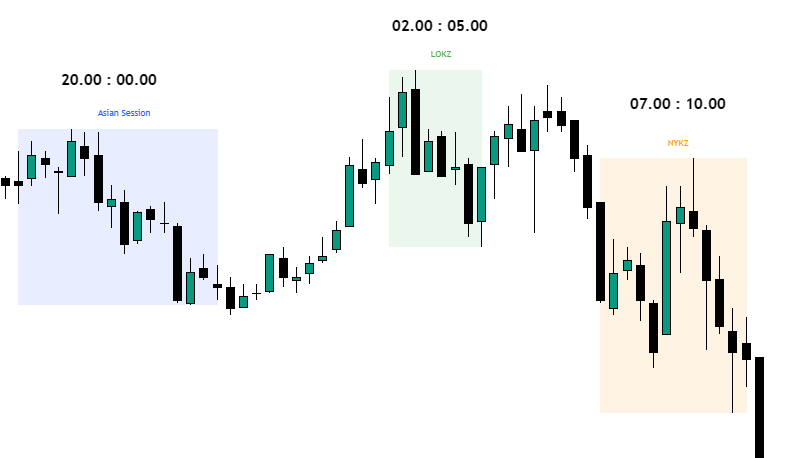

Here's an example taken from a chart showing the effectiveness of what I explained earlier: - Asian High capture with London manipulation - London reversal New - York continuation

Here are a few tips ✍️

- Always wait for a manipulation with a liquidity grab before considering entering a position. - Avoid trading outside of these zones.

- Choose just one kill zone and learn to understand it.

Posting Komentar